Is Social Security Going Broke?

/By Theresa Yarosh,

CGSF Board Member

This is part 2 of a 3 part series.

The Social Security Board of Trustees is reporting through its Annual Report that the trust funds for both the Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI) was little changed from the previous report in 2017, but that “annual balances are slightly worse in the short term and slightly better in the long term.”

The conclusion is that in 2032 the DI Trust Fund will be completely depleted, which is “four years later than projected in last year's report, and ten years later than projected at the passage of the Bipartisan Budget Act of 2015”.

The OASI Trust Fund, on the other hand, will be able to pay full benefits “until 2034”, which is one year earlier than in the 2017 Annual Report, but there are still problems in the future.

The reason for the problems is that the amount that Social Security must pay out annually is larger than what it receives each year.

Social Security receives roughly $800 billion a year in taxes, in 2015 $795 billion (85 percent) of total OASI and DI income came from payroll taxes, while it also generates about another $100 billion from interest earnings on the trust fund to pay current Social Security beneficiaries.

The payout is, unfortunately, much higher as the benefits that the 63 million enrolled beneficiaries received in 2017 totaled close to $965 billion.

At this time, the Social Security Board of Trustees estimates that Social Security has a $13.2 trillion-dollar unfunded liability over the next 75 years. These are the benefits they expect to pay minus the revenue they expect to receive.

Even with this shortfall, there is still a possibility that Social Security will be able to continue as provisions have been created to help minimize what Social Security will have to pay out in the future.

With federal regulations pertaining to retirement, for a person to receive their Social Security benefit they must also accept Medicare when eligible.

Meaning, that when a person is no longer covered by credible health insurance through an employer health plan or a spouse’s employer health plan and they are 65-years old or older, they must accept Medicare or forfeit all of their Social Security benefits.

The other added regulation: the bulk of their Medicare premiums, by regulations, are automatically deducted from Social Security benefits.

You may begin to see what has happened and will, unfortunately, happen in the future; Medicare premiums will inflate at a higher rate than what your Social Security benefit will increase at through Social Security’s cost of living adjustment (COLA)

To further complicate matters, in 2003 Congress, through the Medicare Modernization Act, granted the power to the Centers of Medicare and Medicaid Services (CMS) to implement a surcharge on top of the standard Medicare premiums for those retirees who are earning too much income.

Below are the current 2018 Income-Related Monthly Adjusted Amounts (IRMAA) for Part B and Part D of Medicare (Table 1.)

Thus, those who happen to have not planned accordingly for health coverage costs through Medicare will be subject to not only higher premiums, but they will also realize a much lower Social Security benefit throughout retirement.

Because of these provisions, Social Security is afforded the luxury of not having to pay out the total amount that is due to retirees as their Medicare premiums will work to reduce that benefit.

For those who are not subject to Medicare’s IRMAA, their income is lower throughout retirement; thankfully, there is the Hold Harmless Act.

The Hold Harmless Act of 1984 stipulates that no retiree who is enrolled in Medicare and Social Security can see their Social Security benefits decrease due to Medicare increases.

The result is that those who experience a higher Medicare premium while also seeing their Social Security benefit not increase will be afforded the luxury of having their Medicare premium remain constant while their Social Security benefit will remain the same in that given year as well.

Again, with federal regulations working with both Social Security and Medicare the total amount that is paid out from Social Security will never be as high as previously projected.

Regulations even further the possible viability of Social Security since the Hold Harmless Act was ratified by Congress in 2009 to disqualify those who reach any Medicare IRMAA bracket.

Essentially, only the Standard Premium of $134 per person is going toward the Medicare Trust Fund because the Hold Harmless Act was a subsidy for those at the Standard Premium of Medicare and as such that subsidy is being paid back to the general account via the Medicare IRMAA Surcharges.

Dan McGrath, Co-Founder of Jester Financial Technologies and author of the bestselling retirement planning book “What You Don’t Know About Retirement Will Hurt You” believes “that the main solution to this problem is obvious, and it’s not pretty.”

Mr. McGrath believes that there is not just one solution, but a multiple number of steps that CMS and Social Security can take to ensure that both these programs will remain viable in the future.

For Medicare, Mr. McGrath believes that the first step is to “lower the expenditures paid to healthcare professionals in order to have Medicare being able to control its budget.”

For Social Security, he is under the impression that the federal government will increase the tax on payrolls for those who are still working to generate even more revenue to cover benefits.

The last action Mr. McGrath believes may happen is that the government will take the Medicare IRMAA brackets and adjust them lower so even more retirees will be impacted by it in the future.

Ultimately, with a higher and higher percentage of an individual and couple’s Social Security checks being allocated toward Medicare-related expenditures the ability for Social Security to remain solvent in the future can be achieved.

The issue though is that for many people who will rely on their Social Security benefit to help pay for their expenses in retirement may find themselves having to work longer or changing their lifestyles even more.

As for those in the higher income tiers they may see a day when they are writing checks to the US Treasury to pay for their Medicare.

As their Medicare premiums increase with surcharges from IRMAA and the possibility of their Social Security never increasing and quite possibly decreasing, the bulk of their Social Security benefit will be consumed in its entirety.

The added insult to injury, they will also be taxed on the very same Social Security benefits that they never received.

Is this possible, is Mr. McGrath correct in his assumptions?

Well, according to the Medicare Board of Trustees, in 2026, it may just happen as the proposed Income Related Adjusted Amounts (IRMAA) surcharges are expected to be adjusted due to federal regulations.

With the passing of the Bipartisan Budget Act of 2015 and 2018 not only will the IRMAA brackets change, but they will not be adjusted for inflation until 2028.

At that time the brackets will be adjusted to the CPI-U (Consumer Price Index for all Urban Consumers) on an annual basis to keep Medicare solvent. (Table 2).

Table 2. Proposed 2026 Income-Related Monthly Adjusted Amounts (IRMAA)

These changes are being proposed in conjunction with the expected depletion of the Social Security and Medicare Trust funds as well as containing the future unfunded liabilities.

Dr. Murray Sabrin, Professor of Finance at Ramapo College, states the following situation with regards to the data above “as what I call trickle-down economics, namely well-intentioned but structurally flawed federal programs cannot meet the needs of retirees in a cost-effective manner. Thus, we need to have a national conversation— and action--on how to address the financial tsunami that seniors will be facing for the next couple of decades. In addition, with that said there needs to be a focus on solutions that will properly address these costs not only on the individual level but on the level of National and State pensions.”

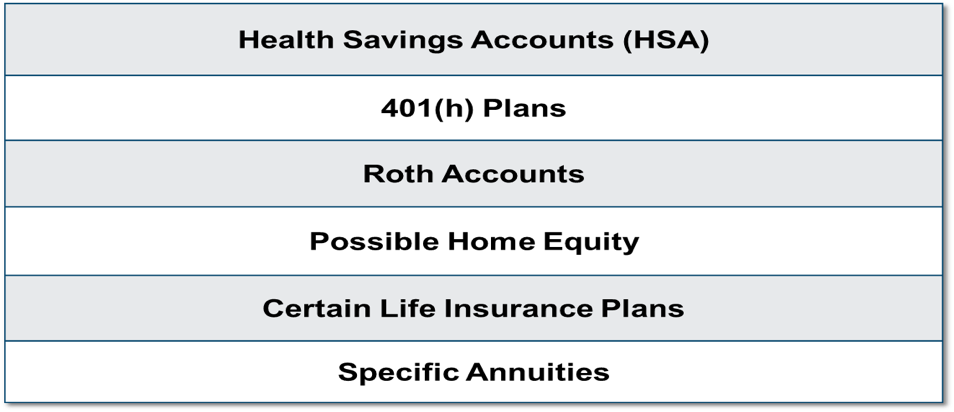

Regardless of the unfunded liabilities as it pertains to both Social Security and Medicare, it is important that individuals and couples start planning now for higher healthcare costs in retirement. It is essential to seek out an advisor who is trained in healthcare regulations, the associated inflation rates as it pertains to Medicare and the planning strategies that need to be utilized to restore the purchasing power of retirement assets and Social Security throughout retirement.

Theresa J. Yarosh, CFP®, CLU®, ChFC® is the Founder and President of Macro Wealth Management, LLC. She has been in the financial services industry for over 20 years. She has worked closely with Dan McGrath over the last three years as it pertains to understanding the Impact of Healthcare Costs in Retirement. She is considered to be on the leading edge of financial planning as it pertains to the impact of healthcare costs in retirement. This specialization has given her the focus to identify what financial products in a retirement plan result in higher healthcare costs versus what financial products do not. This allows for a plan that seeks to contain and reduce ongoing healthcare costs to restore the purchasing power of retirement assets.

She is also the Founder and President of Main Street Medigap, LLC. Main Street Medigap, LLC provides Medicare Supplement Insurance policies to seniors ages 65 and over. Also, Main Street Medigap, LLC also consults Attorneys. Banks, CPAs and other Financial Advisors on Medicare and its related cost structure. She can be reached at tyarosh@macrowealthmanagement.com.

Representatives are registered through, and Securities are sold through Nationwide Planning Associates, Inc., Member FINRA/SIPC, located at 115 West Century Road, Suite 360, Paramus, NJ 07652. Investment Advisory Services are offered through NPA Asset Management, LLC. Nationwide Planning Associates, Inc. and Macro Wealth Management, LLC are non-affiliated entities.